Introduction

Introduction

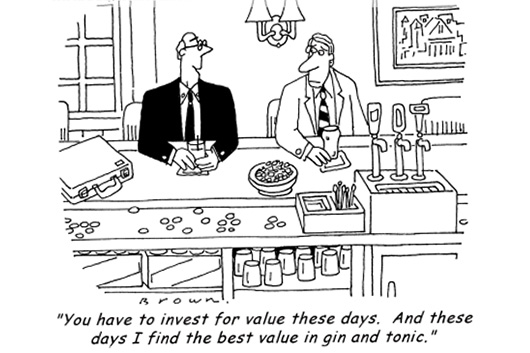

Value investing is a method of picking stocks that was pioneered in the 1930s—when the world was in the midst of the Great Depression. (Just like in comedy, timing is everything…)

The idea behind it is simple: buy stocks that are cheaper than they should be.

Of course that’s easier said than done. Finding stocks that are underpriced takes a lot of research. And once you’ve found them, it often takes a long time for their price to rise. But if you’re serious about investing, you need to understand at least the basics of value investing.

In this course we’ll explain what value investing is. We’ll look at the pros and cons and show you how to identify “value companies”. Then, we’ll look at how to analyze those companies a little deeper.

Value investing isn’t for everyone; this Course will help you figure out whether or not this investment style suits you.

Finally, we’ll introduce you to Warren Buffet. He’s a multibillionaire and the most famous value investor in the world. We can’t make you as rich as him, but once you’ve learned about value investing, you’ll know how to try.

0 comments