Can Your Portfolio Survive A Stock Market Tornado | part 1

Can Your Portfolio Survive A Stock Market Tornado

SECURE THE HOUSE – BATTEN DOWN THE HATCHES – BEWARE A PERFECT STORM MAY BE APPROACHING!!

It is no secret that the stock market has been very crazy as of late. Gold is soaring one day and dropping hard the next. The world is in turmoil. A new President is on the horizon. It's a coin flip and that's probably rigged somehow too. Orlando, San Bernadino, Paris, what's next?

Thousands of jobs are on the line as hundreds of companies are going to face bankruptcy. What happens when markets reacts and sends the DOW under 17,500 to 17,000 then what. The never ending selling will turn the market Neutral then Bearish and leading to a long awaiting recovery. Right after a RECORD S&P 2120, can that really happen?

Are you ready for this? Is your portfolio geared with holdings that will make money as hedge if the markets do this? Is your stock picking strategy well in down markets? Do you even know what to do?

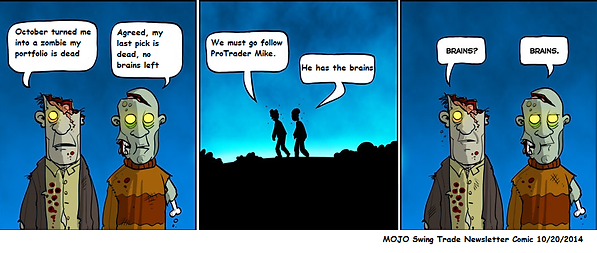

Well I have a good handle on the markets and will be guiding the MOJO Day Trade Room Subscribers & Swing Trade Subscribers to the Promised Land not the Zombie Land of dead stocks. Past comic tells the story as last year this time we had identical scenario...

Traders are getting slaughtered in this market and the battle has not even begun yet. Having a dedicated and knowledgeable mentor and caddie has never been more important. You need a coach and a day trading room you can rely on, not a mentor that will give you his picks, only to leave you holding the bag while he counts his cash! Guess what you were just “front runned” Not at MOJO! At MOJO Day Trading, the picks are given out as they happen and nobody gets left holding the bag. We know chaos is lurking, the market still has some tricks for us, and so we are ready and vigilant. MOJO traders know I am going to be there for them every morning, focused and ready to make money.

If you lose and your one of my students I am getting on the phone with you. ProTrader Pamela has felt her first bump in the road. I spoke to her and eased the pain and patched up the wound to send her back on the right path. Does your mentor do that?

Remember this – the market is orderly and things take time to happen. What you think may be good today may actually play out minutes, days or weeks later – does that mean you were wrong – nope, just means the market is orderly and patience needs to be used in your decisions.

The DOW is moving and in a direction that traders do not want to see. A lot of trouble may be brewing on the horizon and I have called this before, for proof, please take a look at my ‘Dow Megaphone Pattern’ blog post dated June 8th 2015: http://www.mojodaytrading.com/#!DOW-MEGAPHONE-PATTERN/cgpn/557629290cf293eac8053039

I have a history of being correct in these scenarios, as evidenced by this ‘Trading Opportunity of a Lifetime’ blog post dated October 20, 2012: http://protradermike.blogspot.com/2012/10/trading-opportunity-of-lifetime.html

It is pretty clear trouble is brewing. The signs are in the air, just as in 2012 when I studied Michael Burry and correctly corroborated with his predictions. The financial climate remains the same. The same patterns are there. Big trouble could be on the horizon.

So where does this leave you, the average trader trying to make a living in this market? Well, to be frank with you, the next few weeks and months are going to be a struggle for us all. We are going to have display amazing patience and focus to maintain our positive expectation. Thankfully, I am more than ever equipped to succeed in even the most volatile market, as my years of results go to show you. Please be aware of other trading room moderators that do not have your best interest at heart in this market, as I pointed out in my recent videos. Stop losing huge in trading rooms with multiple who leave you holding the bag, come to MOJO and trade with a mentor who will really have your back in the difficult times!

MOJO Day Trading has a plan to combat the dropping DOW and the crazy market. I have spent my entire life perfecting the MOJO system and my patience. I am well prepared to use it. In this market, you have to be well aware of the MOJO Wave Theory, you have to see the waves and wait for the right time to come. Don’t trade just to trade, that is what a loser and a junkie does. Trade like your account is your business, because it is. Every single MOJO ProTrader is an entrepreneur and a business owner. I take pride in that.

Since 2012, more than 150 ProTraders have graduated from MOJO University. The testimonials I have received in return keep the MOJO going. What's a good trade anybody can do that. Changing someones life that is in a bad turn or helping someone realize their financial dreams is what MOJO Day Trading is all about.

This is MOJO Mission statement since 2012:

MOJO Day Trading provides the education and tools necessary for anyone to trade the stock market and replace or exceed prior income, providing a lifetime of financial security.

If you really want to take your trading to the next level, I have the solution for you. The next class of MOJO University starts July 5th. Classes are Tuesday & Thursday Evenings st 8PM to 10PM EST.

The entire classroom program includes approximately (10) classes over 20 hours of live, online classroom hours along with Quizzes and a Final Exam which you must pass to graduate and earn ProTrader status. Students have the ability to ask questions and receive immediate feedback directly from ProTrader Mike. Each class also includes a schedule, course guide and many other resources. After the Classes are over we go over questions/trades/setups and to keep a tight feedback loop.

Program Format:

- Classes Tuesday & Thurday Night Classes from 8:00 pm to 10:00 pm EST

- Online Classes are held in the MOJO University Online Classroom

- Consists of (7) sessions in the (1) Month Classroom Learning period

- Sessions are approximately (2) hours in length (14 Hours Total)

- Course delivered using a live, interactive virtual online classroom, providing environment for optimal learning

- Classes 1 through 4 of the sessions will deliver skill-building lessons that apply day trading.

- Class 5 will apply the skill building lessons learned, and focus on swing trading with an emphasis on MOJO Small Cap Swing Style.

- Class 6 will cover options (call & puts, covered calls).

- Class 7 consists of Q& A with Final Exam.

Specific trading and analysis sessions will be dedicated to the intraday scalper and swing position trader. A classroom of like minded students participating in an environment where teamwork and support is fostered and encouraged.

Class Schedule

- Class 1 Tuesday Night = Lessons 1 - 9

- Class 2 Thursday Night = Lessons 10 - 23

- Class 3 Tuesday Night = Lessons 24 - 35

- Class 4 Thursday Night = Lessons 36 - 52

- Class 5 Tuesday Night = Lessons 53

- Class 6 Thursday Night = Lessons 54 - 56

- Class 7 Tuesday Night = Question & Answer Session & Final Exam

Class Topics:

- Lesson 1 = MOJO Introduction

- Lesson 2 = MOJO Trading Challenge

- Lesson 3 = Tradestation Setup

- Lesson 4 = MOJO Trading Challenge Trading Firms & Fees

- Lesson 5 = How To Achieve 80% Accuracy

- Lesson 6 = Day Trading Mistakes

- Lesson 7 = How To Achieve 85% Accuracy

- Lesson 8 = Pillars of MOJO Trading

- Lesson 9 = How To Achieve 90% Accuracy

- Lesson 10 = Goal Setting

- Lesson 11 = How To Achieve 95% Accuracy

- Lesson 12 = Level 2 Basics

- Lesson 13 = Level 2 Tips & Secrets

- Lesson 14 = MOJO Wave Theory

- Lesson 15 = MOJO Styles of Trading

- Lesson 16 = Range Trading

- Lesson 17 = Trend Trading (Now & Later Trade Play)

- Lesson 18 = MOJO Summary Recap of Class 1 & Class 2

- Lesson 19 = MOJO Price Increments

- Lesson 20 = HEINZ Trade Play

- Lesson 21 = Stopping Stations

- Lesson 22 = Scaling & Buying Power

- Lesson 23 = Mental Power & Trading Psychology

- Lesson 24 = MOJO Day Trading Rules

- Lesson 25 = MOJO Goal Sheet

- Lesson 26 = MOJO Tracking Sheet

- Lesson 27 = MOJO Routine

- Lesson 28 = Bankroll Management

- Lesson 29 = Trading & Poker

- Lesson 30 = Charts 101

- Lesson 31 = Stochastics

- Lesson 32 = Market Makers & ECN's

- Lesson 33 = Hiding Orders & Fakes/Tricks

- Lesson 34 = Speed Practice

- Lesson 35 = NITSO & NITBB

- Lesson 36 = 1+1+1+1=4 Winning Formula

- Lesson 37 = Premarket & Afterhours Trading

- Lesson 38 = MOJO Trade Play Book (14) Trade Plays

- Lesson 39 = CUPID TOP Trade Play

- Lesson 40 = RAIL GRIND Trade Play

- Lesson 41 = ONE SHOT Trade Play

- Lesson 42 = HEINZ Trade Play

- Lesson 43 = MINI HEINZ Trade Play

- Lesson 44 = GONZO Trade Play

- Lesson 45 = LEMON SQUEEZE Trade Play

- Lesson 46 = WOW Trade Play

- Lesson 47 = BOX Trade Play

- Lesson 48 = BUMP Trade Play

- Lesson 49 = HULK Trade Play

- Lesson 50 = GREEN GIANT Trade Play

- Lesson 51 = TAG ALONG Trade Play

- Lesson 52 = Maximizing Trades

- Lesson 53 = Swing Trading

- Lesson 54 = Options Trading Basics

- Lesson 55 = MOJO Covered Call Writing

- Lesson 56 = MOJO Triple Threat Strategy

Learning Objectives:

Upon completing this course you will master the core foundational concepts including:

- Game Plan Enablization

- Goals & Strategies to Accomplish the Outcome Goals

- Understanding Price Increments and Trading Ranges

- Trading Using Price Action Support and Resistance

- Trading with Charts using Stochastics & Bollinger Bands

- Candlestick Charting

- Use of Volume & Momentum

- Mastering the Level 2 & Understanding Market Makers, ECN's

- Dynamic "real time" Trend analysis

- Beginning to Advanced Charting Techniques

- Specific Set of Rules for both Day Trading and Swing Trading

- Journaling and reporting success and failure

- Application of additional trading tools to enhance overall and long term performance

- Learn PATIENCE and be able to consistently identify low risk/high reward opportunities in the market

- Complete and implement your personal trading plan based on the MOJO Style of trading

- Have a clear understanding of the markets, and time frames that best fit a style of trading to your personality, life style, and risk tolerance

http://www.mojodaytrading.com/university

0 comments